Giffen Goods, Tulips and Bears Oh My!

By Douglas Borthwick & Frank T. Troise

We were both fortunate to go to some of the more prestigious undergraduate and graduate universities in the world. We both had a focus in Economics and Finance and somehow managed to graduate.

Underlying that education were some basic assumptions:

· The risk free rate

· The role of a fiduciary

· Free markets

Yet, as we look at today’s market, and the factors underlying it, we have come to realize that viewing the markets through the lens of a rational investor today, is in fact, the least rational thing to do. This market is being driven by central bank policies that make a mockery of valuation, pricing, and exit strategies.

A few decades ago we held a belief that equity markets in developed market economies rose and fell in accordance with company profits and earnings. The stock market was looked on as a separate entity from the economy. It could rise when the economy fell and vice versa. Today the stock market is seen as a proxy for economic growth. A higher equity market is highlighted as a sign of economic strength.

This conclusion harkens back to some of the basics of what we were taught regarding valuation and pricing. An equity’s price is, or should be, a function of its underlying cash flows (earnings/dividends), and some “goodwill” thrown in for added measure. Valuation was discounted using the risk free rate, which is/was a government interest rate determined by the free market.

This couldn’t be further from the truth today. Today’s higher equity prices come as a direct result of corporate buy backs and extremely low interest rates that are not set by the market, but rather forced lower by Central Banks as they nationalize their relative Sovereign, Mortgage and Corporate Fixed Income markets through quantitative easing.

These lowered interest rates serve two purposes. They increase the Net Present Value of equities as the discount rate is adjusted lower, and they encourage companies with listed equities to issue bonds at low rates in order to buy their own stock back in the market.

In the old days, bonds rose when stocks fell. Bonds rose as Central Banks cut rates to stimulate the economy. The slowing economy would have been evident in a lower stock market. In times of expansion, portfolios would be overweight equities relative to fixed income. In times of contraction, equities would be underweight relative to fixed income.

These days it is best to be overweight both equities and bonds… With the crowded popular notion that Central Banks will not step away from quantitative easing because the consequence would be economic contraction. It sounds like the Central Bank mandate has shifted from employment and inflation to keeping equities bid… Otherwise known as the FED Put.

This creates a unique fiduciary dilemma. Using some very basic math, one could easily rationalize that the DJIA today should be somewhere between 24,000 to 28,000 (depending on what equity return assumption you use in 2007/2008 and then project that forward). As the world’s pensioners calculated their financial plan in the midst of the Great Recession, their savings were slowly and methodically whittled away. What is their option today? They have no choice but to follow the central banks, and double down on risk.

How does Wall Street reconcile to that? It doesn’t and it fights strongly to have the fiduciary standard removed from its responsibility. This simple irony is at the core of the pension dilemma facing the world today as individuals and sovereigns realize their financial shortfall(s).

Rather than pontificate on the merits of what we learned at school, we have decided to change our perspective to that of the irrational investor. What would we do if we had no education, no valuation expertise, no fiduciary responsibility to anyone, and simply succumbed to the tulip mania we are all seeing today?

We are confident in our assumption that current markets show similarities to the Tulip heights of March of 1637, will be met with doubt by many in the investing community. However we believe we are merely stating what most investment professionals already acknowledge behind closed doors.

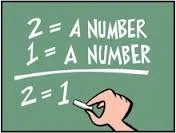

We believe that what we are witnessing across global markets is the manifestation of what Scottish economist Sir Robert Giffen aptly described in the late 1800’s as “Giffen Goods”. The definition of a Giffen good is here:

A Giffen good is a good for which demand increases as the price increases, and falls when the price decreases. A Giffen good has an upward-sloping demand curve, which is contrary to the fundamental law of demand which states that quantity demanded for a product falls as the price increases, resulting in a downward slope for the demand curve. A Giffen good is typically an inferior product that does not have easily available substitutes, as a result of which the income effect dominates the substitution effect.

Could we categorize Sovereign Debt as Giffen goods?

There are nowadays so few AAA rated Sovereign debt instruments that their lack of substitutes, in combination with quantitative easing has resulted in them being well overpriced relative to where they would be in a regular free market.

What should we do to become irrational? To be a successful irrational investor is a process that involves several steps:

Step #1: Forget prudent man/fiduciary protocol. To become a successful irrational investor, one must renege on any common-sense you initially portrayed to clients. That won’t work today. Abdicate any responsibility to your clients and, if possible, have them indemnify you for any of your future decisions. Of note the recent lobbying efforts by Wall Street to Treasury/DOL on any fiduciary definition/responsibility.

Step #2: Hit the pain point: Baby Boomers. Their retirement expectations are bankrupt and are only now beginning to see the dilemma they are in. Once they have given you a free legal pass to their portfolios, you can double down. Why? They are already so far behind the retirement curve they are desperate. If they ask for traditional MPT/efficient market logic, then pass on them as client accounts. Mathematically you cannot win that battle.

Step #3: Forgot about valuation/pricing. This is all about momentum. There is no true “risk free rate” today underpinning any valuation/pricing analysis. Throw that out. It is all central bank driven and governments are buying everything. What’s another way to look at valuation? The central banks are nationalizing the debt and equity markets. What does this mean for passive investing? It is the cheapest way for you to rationally implement an irrational investment strategy.

Step #4: Forget about true labor growth. While it may look like there are jobs, the underlying numbers are BAD. No real productivity growth since WWII and wage growth that barely keeps up with inflation. Remember, technology is deflationary. Uber has driverless cars; do you really think you are safe?

Step #5: Go Russia/China. Why? Everyone else is building walls and going isolationist/nationalist. Who benefits the most? Russia and China. Stable governments execute trade deals, and the rest of the “modern” world has forgotten this. Look no further than the oil in Africa deals both Russia and China have negotiated.

Step #6: Go infrastructure. The USA has so far decided to forego negative rates. Instead, they appear ready to issue more debt to build infrastructure. Whether to build a wall, new roads or new bridges, significant infrastructure spend is coming to the US.

Finally, while we wrote this post as a tongue-in-cheek exercise, we found ourselves nervously laughing. Why? We both have young children and our kids are beginning to understand the world’s problems in their social studies classes. But who cares? Our children will commit us to a Florida retirement community and pay for our health care as we watch the rising waters from global warming approach our beachfront condominiums.

About the Authors

Doug Borthwick is a Managing Director and the Head of Foreign Exchange at Chapledaine FX, a Tullet Prebon Company. Mr. Borthwick has served as the Managing Director of Chapdelaine FX, a division of Tullett Prebon since its inception in October, 2012. His business serves institutional investors and global financial institutions, providing electronic and voice enabled trade execution in foreign exchange; combined with market moving commentary.

Douglas was formerly a Managing Director and the Head of Research and Trading at Faros Trading LLC. He spent 10 years with Morgan Stanley in New York and London managing the Asian NDF and the G20 deliverable forwards desks. Douglas also ran Proprietary Trading with Merrill Lynch and ran the Latin American FX trading desk at Standard Chartered Bank. Douglas was a member of Institutional Investor ranked teams in both US and Latin American Economics at Lehman Brothers.

Douglas is regularly interviewed on Bloomberg, CNBC and the WSJ, with his opinions often sought by institutional investors. Douglas holds a BS in Economics from Carnegie Mellon University and an MBA from Yale's School of Management.

Frank T. Troise is a Managing Director and the Head of Digital Distribution and Communications (Asia) for Leonteq Securities (Singapore) Pte. Ltd. (member of the Leonteq AG group SIX: LEON). He is responsible for digital distribution and communications across Asia for Leonteq’s three main businesses in Asia: Structured Solutions, Platform Partners, and Pension Solutions.

DISCLAIMER

The information presented in this article/post is provided “as-is” with no warranties, and confers no rights. The information contained, and any opinions or views expressed, in this article/post are not intended to be, and do not constitute, investment research, recommendation or advice on any securities, investment products and/or instrument or to participate in any particular investment strategy. This article/post has not been reviewed by, and does not reflect or represent the opinions or views of, Chapledaine FX, Tullet Prebon, or Leonteq. Unless expressly stated, it is or represents solely the opinions or views of the author(s).