“You call it procrastination? I call it thinking

Aaron Sorkin”

As the public markets trade sideways, investors have worked themselves into a frenzy over “FinTech”. The FinTech assumption is that financial institutions are absolutely incapable of innovation, and are being mercilessly out-maneuvered by young innovators and disruptors.

Or are they?

Let me challenge the current euphoria, and use the innovators own material as a basis for comparison.

Case in point: original thinking.

TED talks recently had a fantastic talk about “The surprising habits of original thinkers” by Adam Grant. The link to it can be found by clicking here or below:

In it, Grant highlights three key facets to original thinking and “Originals”:

- They procrastinate

- They feel fear and doubt

- They have lots of bad ideas

Let’s look at this via a well-known example. Apple launched a unique GUI with the first Mac. Great product. Great advertising. Great buzz. But no commercial viability.

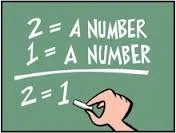

Microsoft watched and carefully followed Grant’s paradigm of original thinking. From that came Windows and Bill Gates ...the wealthiest man in the world.

As Grant says: “Different and Better”.

Who learned from that? Steve Jobs.

The next time, Jobs applied his creativity differently, pragmatically and ultimately succeeded. Look no further than Apple’s market capitalization today.

As we look at FinTech, and overlay original thinking, the fallacy lay in several key themes:

- Are any of the technologies truly unique?

- Is there any viable path to profitability?

- Does it have the balance sheet to withstand regulatory scrutiny?

“Or, is the FinTech reality one simple truth: lower prices/costs.

”

Challenge me. Take a hard look at each FinTech vertical: Peer-to-peer, crowdfunding, robo-advice, block chain, etc. Show me one that negates the three themes that I have highlighted.

Or, is the FinTech reality about cheap human capital, iterating in isolation, whilst the financial institutions wait, and then do something different and better?

…I think you know the answer.

In the weeks and months ahead, I look forward to sharing with you the success stories of the improvers as they simply make things different and better.

Frank Troise is one of South East Asia's leading voices on FinTech. He is a Managing Director and Head of Digital Distribution (Asia) for Leonteq (SWX: LEON) He is an active advisor to many of Asia’s leading financial firms, management consulting firms, technology companies, venture capital funds, hedge funds, and start-ups.