1987: Déjà vu

Last time I wrote, I compared the US Administration’s economic policy as “throwing the kitchen sink” at the US economic malaise.

In fact, the US has done just that.

A tax package that benefits corporations, and provides very little for the middle class it was meant to help. That same tax package will not generate the revenue necessary for the deficit to recover, and the US debt will balloon as a consequence.

To add to the US dilemma, to help spur manufacturing growth, US policy makers are now talking down the US dollar. As Secretary Mnuchin stated, this is good for manufacturers as it makes their goods cheaper for export.

Regulators are under increasing pressure by the Administration to loosen regulations. This will allow banks to lend again to a US consumer, who while spending more, is saving less. We need look no further than the recent data from the US Commerce Department to see the similarity to 2005 when we last saw the US consumer on a leverage binge. That ended well for no one.

The clock is ticking for the US as it plans one last manufacturing “hurrah”…the infrastructure bonds. This is on top of the $441 billion of borrowing announced this quarter. It is ironic that the USA is planning more debt as the Federal Reserve begins stepping back from its QE policy. Less demand and more debt means one thing: higher yields.

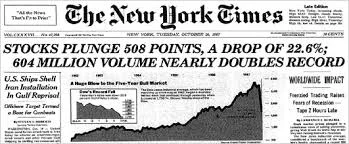

When did we last see these factors appear? Look to the months prior to the Crash of 1987. Like today, we saw a sell-off in bonds alongside a weakening dollar.

While I hate standing in front of market freight trains (regardless of their speed), it is clear that the market is showing the signs for investors to be concerned. Sadly, the euphoria of rising stocks in tandem with Bitcoin may have sedated investors that this is not déjà vu, but rather the new normal (again).

Singapore & Sydney!

Excited to speak on Monday February 5th at GIC for their event with the FWA on FinTech Disruption. I will be speaking with my good friends at Synpulse Management Consulting.

In late February 21-23, I will be speaking at RFI’s Mortgage Innovation Summit Event in Sydney. If you are in town, let me know and it would be good to get caught up then! The link to the event is here.