My wife and I had the pleasure of another 50th birthday party this week. Capping a FULL week of business entertaining. So, suffice it to say, I am slightly worse for wear today.

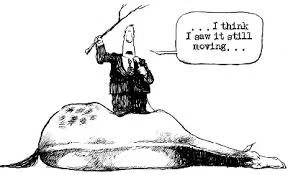

That allows me to "borrow" some great thoughts from others this week. Whilst still sounding the alarm, hence the "dead horse" analogy, that we should all buckle up.

First, FinTech is wrapping up.

Folks in the industry were talking about the Blackrock-FutureAvisor deal at length. 50x is a big premium, however, Blackrock doesn't strike me as a cavalier firm wrt valuation. Cash + earnout seems more likely. Winterberg does an apt analysis here in his weekly video:

For the investment bankers out there, I found this presentation by Steve's team terrific. They banked the deal for Blackrock. Again, they know valuation (click here for the deck).

Second, the great unwind may be beginning.

What has me occupied this weekend? CHINA.

Why? They own a lot of our debt.

These two pieces on them and Saudi Arabia were fascinating synopsis' that encapsulated the talk of many prop desks this week.

“If China is selling, the US yield curve is TOAST”

Here is the link to the Saudi article about their cash reserves.

Here is the link to China's sale of US Treasuries.

Third, Trump.

From here, it looks like the US is prime for a demagogue. Sadly, he fits the bill. While I appreciate the mathematical reality that he will, and should, ultimately fade away...he is highlighting a side of America that is shameful.

Finally, speaking of 50th birthdays, how was it here in Singapore? Let me share that on my next post.

In the interim, enjoy the weekend!