First off, Happy Easter to all of our friends back in the USA! We will miss this holiday season with all of you.

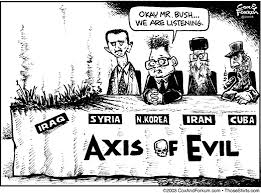

One of the things that has been interesteting to witness is the reaction to the USA-Iran negotiations from here. "Is Iran really part of the Axis of Evil that the West espouses?"

I am not smart enough to fully answer that, but I think several observations from the ex-pats here are important.

- The price of oil has dropped significantly. Is this driven by us? The Saudis? Or fundamental supply/demand reasons?

- The US economy still seems "stuck". This is the most worrisome. A price pull back should have garnered some economic growth, but it hasn't achhieved that. In fact, we see articles here about Tesla being impacted and able to carry on with regards to cheaper gas prices.

- Where is Russia in all of this? With the impact to their reserves, have we really just effected a win in the economic "war column"?

- Would it be that bad if the US vacated a Middle East footprint and scaled back? Why is this a bad outcome for the US?

All of this is concerning as we watch the price activity in the equity and bond markets.

I personally feel that the price of oil is a policy decison, not an economic outcome. To be clear, I think it was deliberate and engineered. What better way to impact an enemy?

However, for investors, the alarm bells have risen demonstrably. We are not seeing the activity of a healthy equity market. We are seeing the opposite as investors clamor for riskier investments (of note the SEC ruling on crowdfunding). Truly, the shoe shine boys can now buy pre-IPO stocks. Why? Because the institutional money will not.

My thought? I agree with William McChesney Martin...it is time to take the punch bowl away. Enjoy the chocolate, but come Monday, begin thinking about taking some money off the table.